With the gloomy global economic crisis that we are presently experiencing , I believe its about time that we keep track of our daily expenditures and strictly follow our family budget so we do not end up on getting payday loans.Here are some BUDGETING TIPS

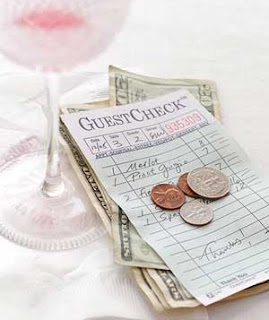

1. Start by creating a diary list of all your daily purchases. This list will help you track where your money is going.

2. With the budget diary list mentioned above, evaluate your spending habits. Try to itemize your list into two categories. First category would be for your basic need sand second category for those you consider as luxury. This way, you'll be able to assess if you're already spending more that what you really need. if you think that you're spending to much on unnecessary things then better adjust your expenditure routines.

3. Create your budget for the month. I highly suggest that you use the simple accounting method. Income less Expenses... and this procedure it's easy if you will use Microsoft Excel.

You can create multiple columns such as.. All expenses: Mortgage o rentals, utility bills(include water, telephone cable, Internet) another one is car expenses (such as gas and maintenance), insurance, loans (such as credit cards) so after you listed all the monthly expenses right away you can determine if your income on the particular month is enough for the expenses in your list. And after this computation you can instantly see how much you can save or how much you can spend aside from the regular expenses. Or it will help you to spent less if your income is not enough for all the payable.

Income (salary) ---------------XXX

Other ------------------------XXX

Less:

Expenses --------------------XXX

TOTAL ---------------------XXX

Income represent the amount remaining after all the deduction base on the expenses you have jot down in your expense book... hope this help in some way..

No comments:

Post a Comment